By Tony Buckle and John Carolin | October 24, 2023

This article, which was first published in Insurance Journal’s sister publication, Carrier Management, was highlighted in a Forbes article titled “How Insurance Teams Can Combat Herd Behavior” on Oct. 12.

While discussing soft market underwriting may seem ill-timed given current strong results and hard market conditions, there are worrying signs that underwriters are beginning to chase market share in certain specialty classes.

Consider this recent observation from Patrick Tiernan, chief of markets at Lloyd’s of London, about the D&O line of business: “I think we are all running out of adjectives to describe the moronic underwriting approach being adopted by some elements of the market.” (Q3 Market Message – Lloyd’s (lloyds.com) at 4.49 minutes)

It is a refrain being echoed by others.

As a result, we believe now is the right time to review what happened in the most recent soft market. Was underwriter behavior moronic? Or was it actually rational in some way? And what can management and particularly chief underwriting officers do to mitigate the excesses of the market cycle next time?

To better understand underwriters’ behavior, we conducted research into specialty underwriting during the soft market between 2013 and 2017. With the support of the International Engineering Insurers Association and SBS Swiss Business School, we surveyed the global community of engineering and construction underwriters (120 respondees from 31 countries) to understand why they wrote the risks they did during that period. (See related article from UWX: Repricing Is Not Reunderwriting )

Was it because they were unaware that the market was soft? While there was some variation in local markets where smaller risks appear to have been less affected by market gyrations, underwriters were clear—and dare we say, honest—that they knew the market was soft and that terms and conditions were insufficient. (See chart below.)

Engineering and construction is generally an attritional class, subject to lots of small losses rather than spectacular catastrophes. In such a class you would expect more losses as terms and conditions soften, so it’s not a surprise that underwriters strongly denied that their poor results were simply due to bad luck. (See chart below.)

If underwriters knew they were in a soft market and could essentially foresee the poor performance of the risks they were underwriting, why did they take those risks on?

Underwriters point to several factors, but two themes stand out. First, they say they wrote business to meet expectations—to be recognized as a player in the market, to serve brokers and clients, and to achieve management performance targets. (See chart below.)

Second, underwriters wrote business on the terms they did because they felt disempowered. They felt unable to change the terms and conditions of the risks they were being offered. (See chart below).

They also often felt incapable of challenging the performance targets that management had set for them. To quote one respondent: “Underwriters cannot write both for profit and premium in a soft market. Management used to say, ‘write the profitable risks.’ But how do you do that in a soft market?”

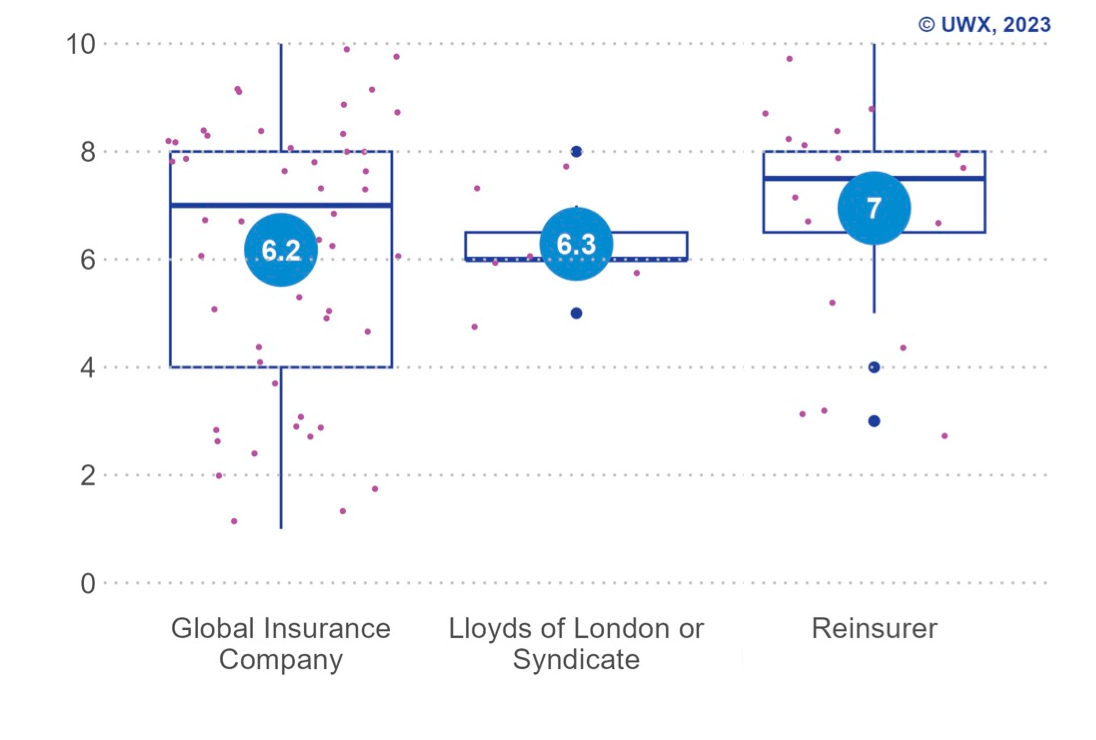

The role of senior management cannot be understated. Underwriters are really looking to senior management to set the narrative. They will achieve the targets that senior management set. This was found to be particularly the case for underwriters from global insurers, Lloyd’s and reinsurers as the graph below illustrates.

Where does this leave us?

As Albert Einstein said, “A problem defined is a problem half solved.” So, a vital first step is recognizing the realities of the soft market and taking responsibility for navigating a path through it. This requires management to both assess and communicate where they see themselves in market cycle and plan and measure performance accordingly. It means understanding the motivations of underwriters and being clear on expectations and maintaining a strong two-way dialogue.

Performance metrics really do matter and should evolve through the cycle, with a focus on leading indicators of performance, rather than lagging ones. For example, a leading indicator would be an increase in the number of claims reported, which provides early evidence of a growing inadequacy of deductibles. On the other hand, accounting year loss ratio metrics are the result of underwriting decisions taken many years previously. The rear-view mirror only tells you where you have been, not where you are going.

At the board level, it is vital to recognize that the market cycle is not simply a function of capital availability. People and their behaviors drive the cycle. Boards need to challenge management on their cycle approach, recognizing that different lines of business have different trajectories. They need to focus on underwriting-year performance as much if not more than accounting-year performance. Only then can they intervene proactively and challenge behavior effectively.

In so doing, they would be fulfilling three of their key responsibilities. First, they would be protecting their firms’ balance sheets, brands and market profile. Second, they would be providing a vital service to their customers by enabling consistency of approach and service. Third, and perhaps most important, they would be enabling their employees to act with integrity, raise concerns about current trading conditions and align on priorities.

Even if not imminent, softening will return to the commercial insurance market. The current downward trajectory in D&O is but an early warning of that. But with improved coherence and transparency, grounded in solid data and open communication, the worst excesses of the soft market can be avoided. History might rhyme, but it does not have to repeat itself.

Prepare for the Soft Market: Why You Need to Set Performance Metrics Now - UWX says:

[…] they did during that period—when precisely the opposite conditions to today prevailed. (See related article, published by Carrier Management in […]